The recent merger announcement between Kansas City Southern (KCS) and Canadian Pacific Railway Limited (CP) has sent ripples through the transportation and logistics industry. As the two major railway companies combine forces, this strategic move will undoubtedly have a significant impact on various sectors, including industrial real estate. In particular, the merger is poised to bring substantial changes and opportunities to the region between Louisiana and the upper Midwest, as the improved rail network connects key industrial hubs. Let’s delve into the potential effects this merger could have on industrial real estate in this vital corridor.

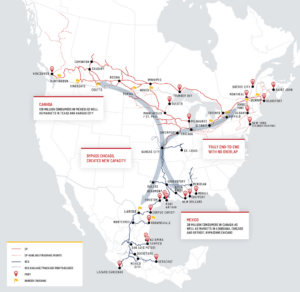

(Railway Map courtesy of CPKC)

Enhanced Connectivity and Transportation Efficiency:

The merger between KCS and CP will result in an expanded and more interconnected railway network stretching from the Gulf of Mexico through the Midwest and into Canada. The improved connectivity and transportation efficiency will likely attract businesses to the region, leading to increased demand for industrial real estate. As companies seek efficient transportation solutions to move goods across this corridor, strategically located industrial properties will become more valuable.

Growth of Intermodal Facilities:

Intermodal facilities, where goods are transferred between different modes of transportation, are crucial in today’s supply chain. The merger between KCS and CP will likely spur the growth of intermodal facilities along the Louisiana-to-upper Midwest route. These facilities, which facilitate the seamless transfer of goods between trucks and trains, will play a vital role in accommodating the increased transportation volumes resulting from the merger. Consequently, the demand for industrial real estate in proximity to intermodal hubs is expected to rise, as businesses seek convenient access to efficient logistics networks.

Emerging Industrial Clusters:

The merger is likely to stimulate the emergence of new industrial clusters or strengthen existing ones along the Louisiana-to-upper Midwest corridor. As transportation infrastructure improves, businesses in sectors such as manufacturing, distribution, and warehousing may be drawn to this region. The availability of rail connectivity will make it easier for companies to transport raw materials, components, and finished goods across multiple states, fostering economic growth. The resulting industrial development will, in turn, generate demand for industrial real estate, such as warehouses, manufacturing facilities, and distribution centers.

Job Creation and Economic Growth:

The merger between KCS and CP is expected to generate numerous employment opportunities and drive economic growth in the corridor. The expansion and optimization of the railway network will lead to increased trade, attracting businesses and industries that rely on efficient transportation. The subsequent growth in economic activity will create a ripple effect, positively impacting the industrial real estate market. As businesses establish operations and expand their presence in the region, they will require suitable industrial spaces, leading to increased construction, leasing, and investment activities.

Challenges and Considerations:

While the merger presents promising opportunities for industrial real estate, it also brings certain challenges and considerations. The increase in rail traffic could lead to additional demand for land near rail lines, potentially driving up prices. Additionally, communities and municipalities will need to address potential environmental concerns and plan for increased infrastructure capacity to accommodate the surge in transportation activities.

Conclusion:

The merger between Kansas City Southern and Canadian Pacific Railway Limited will have far-reaching implications for various industries, including industrial real estate between Louisiana and the upper Midwest. The improved connectivity, growth of intermodal facilities, and the emergence of industrial clusters could possibly drive demand for industrial properties in the region. Moreover, the job creation and economic growth resulting from this merger could further contribute to the dynamism of the industrial real estate market. As the integration progresses, stakeholders in the industrial real estate sector should closely monitor developments and adapt to capitalize on the opportunities brought about by this transformative merger.

For more news and information regarding Sealy & Company, please visit the company’s website at www.Sealynet.com.

About Sealy & Company

Sealy & Company, a fully-integrated commercial real estate investment, and operating company, is a recognized leader in acquiring, developing, and redeveloping regional distribution warehouse, industrial/flex, and other commercial properties. Sealy provides a full-service platform for high-net-worth individuals and institutional investors through our development, management, and brokerage divisions.Sealy & Company has an exceptional team of over 100 employees, located in five offices, with corporate offices in Dallas, TX and Shreveport, LA.