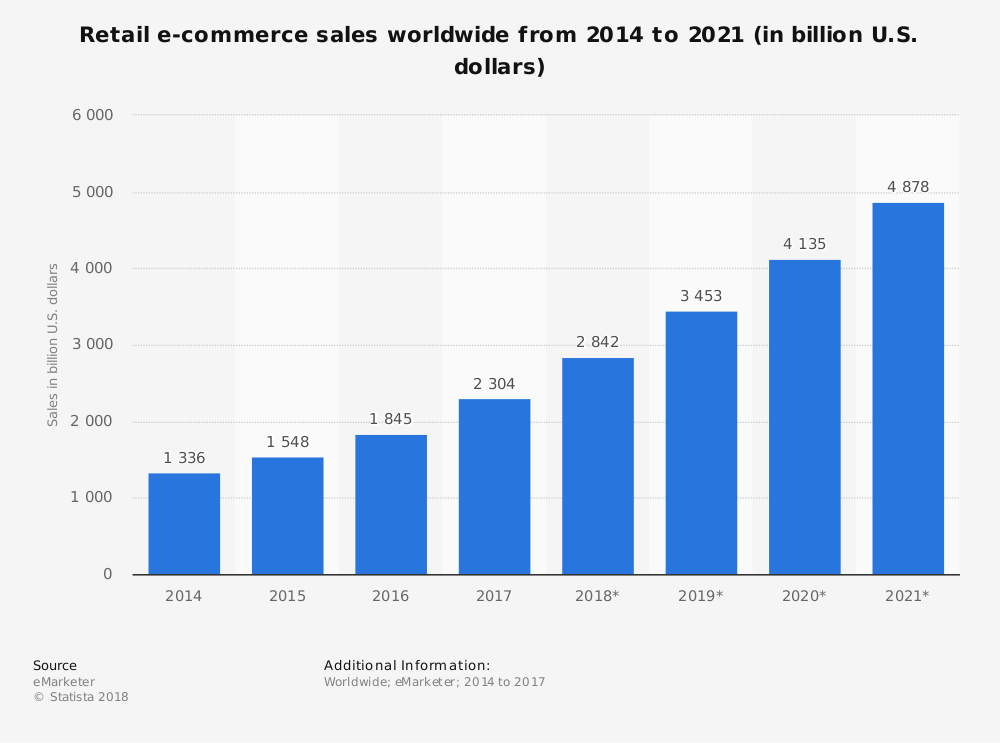

The widespread growth of e-commerce over recent years has made a significant impact on the retail landscape, and brick-and-mortar stores are adjusting their focus as they compete with the disruption caused by e-commerce’s one-click shopping and front-door delivery. This impact, according to the U.S. Census Bureau, can be seen in e-commerce sales accounting for nearly 10% of all total retail sales as of 2018Q2. The same report details the rapidly compounding growth rate and estimates e-commerce will account for almost 25% of total sales in the next decade. This “Amazon effect” attributes the shifting world of online retail sales to revolutionary front-runner Jeff Bezos and his online sales king, Amazon.

The effects of the changing retail landscape are clear, cited with totaling $3.5 billion in online sales next year, and the industrial real estate landscape has dually shifted to accommodate the rising need of distribution centers. The demand for efficient distribution space that facilitates quick movement of goods has influenced both the nation’s real estate developer, investor, and buyer.

Studies by CBRE, with whom Sealy & Company works closely in major retail distribution cities like Dallas, report that for every one billion growth in e-commerce sales, an additional 1.25 million square feet of distribution space is needed. Therefore, industrial warehouses are being constructed with more square footage, taller clear heights, and with the potential for land expansion. Likewise, vacancies in industrial warehouses are falling with some real estate companies noting that nearly half of their large leases completed last year were from e-commerce companies and a sizeable portion of their warehouse and distribution portfolios are comprised of e-commerce facilities.

The trend of e-commerce is only expected to rise, indicating investment in the industrial real estate sector will produce long-term benefits. Subsequently, it continues to allow for e-commerce distribution center expansion and development, particularly in locations with quick national distribution access through functionally configured roadways, railways, and by way of air travel. However, despite the overwhelming statistical evidence that e-commerce is unsettling for the future of retail, Business Insider reports that grocery stores may revive the retail industry. The conversion of unfrequented retail locations to supermarkets might bring other real estate investment and development opportunities as well as bring to life recent predictions of retail revival. For now, however, the distribution centers housing the e-commerce giants are expected to continue steadily dominate the changing retail scene.

Sources:

- PwC Deals: US Real Estate Deals Insights Q2 2018

- Retail E-Commerce Sales Worldwide From 2014 to 2021 (in billion U.S. dollars)

- HOW HAS E-COMMERCE SHAPED INDUSTRIAL REAL ESTATE DEMAND?

- Are Grocers the Answer to Retail Woes?

For more news and information regarding Sealy & Company, please visit the company’s website at www.Sealynet.com.

About Sealy & Company

Sealy & Company, a fully-integrated commercial real estate investment, and operating company, is a recognized leader in acquiring, developing, and redeveloping regional distribution warehouse, industrial/flex, and other commercial properties. Sealy provides a full-service platform for high-net-worth individuals and institutional investors through our development, management, and brokerage divisions.Sealy & Company has an exceptional team of over 100 employees, located in five offices, with corporate offices in Dallas, TX and Shreveport, LA.